Contact

Contact

A2C - Applium Chorus Connector

Applium A2C connector is a user friendly response to the obligation of e-invoicing in France.

E-invoicing has become mandatory feature in the public secotr since 2017. It was gradually extended to its suppliers until 2020 (B2G flow) .In the coming years, the electronic invoicing obligation will gradually be extended to transactions between companies (B2B flows).

The Public Invoicing Portal (PPF) is developed by the AIFE (State Financial IT Agency). It's being updated frequently with new functionalities. Access i free of charge with "portal mode" to upload the invoices "by hand". It can also be used in EDI and API mode in order to ingration automation.

By using the API feature, Applium developed its own connector allowing SAP users to automate sending and receiving electronic invoices to PPF.

B2B E-invoicing

Business to business electronic invoices is regulated as of today.

Decree No. 2022-1299 of October 7th, 2022 as well as articles 289-bis, 290 and 290-A of the CGI which will apply on July 1st, 2024 set the rules for electronic invoicing and the transmission billing and payment data. These measures will apply to all those subject to VAT in France :

- from July 1st, 2024 for all taxable company regarding of the reception obligation,

- between July 1st, 2024 and January 1, 2026 step by step depending on the size of the companies concerning the issuance obligation.

Circuit A of the "Y" diagram

In the external electronic invoicing specifications published by the AIFE, the various players appear in the ‘Y diagram’ which stems from article 289 bis of the CGI. In this diagram the direct connection to the PPF which is used by A2C is referenced as 'Circuit A' between two actors who directly use the public billing portal.

The A2C connector covers both functional perimeters of circuit A using the dedicated APIs:

- Transmission flow for the 'Supplier' role

- Reception flow for the 'Buyer' role.

The benefits are :

- Cost reduction, as the PPF API services are free

- Simplicity, as direct communication to the PPF eliminates the need to use third parties (OD or PDP),

- Compliance, because invoices are issued directly by A2C in the standard UBL format expected by the PPF

- Efficiency, as this implementation choice allows for flow control and avoids the risks associated with the multiplication of actors and interfaces.

Summary presentation of the A2C connector:

To meet the obligation of electronic invoicing in France, Applium offers a standard connector between SAP ERP (ECC6 or S/4HANA) and the public invoicing portal, A2C (Applium Chorus Connector), covering the following needs :

e-invoicing

- sending invoices to the Chorus Pro portal

- Receiving invoices from the same portal

- updating of invoice statuses

e-reporting (release in 2024)

transmission of invoicing and payment data requested by the tax authorities

A2C is an On Premise type solution, with unlimited usage rights and annual maintenance covering upgrades. The metric of the A2C solution is the total number of invoices received, issued or declared by e-reporting over a year (in blocks of 1,000 invoices, with a minimum of 5 blocks). We do not differentiate between invoices received, issued or declared by e-reporting.

Prices are based on the volume of annual invoices and can be adapted to small budgets.

A2C embeds evolving mechanisms that allow us to anticipate legal developments more easily. These are taken into account in the maintenance of the solution. We provide regular technological monitoring through the 'Software editors and dematerialization operators' college of the AIFE.

A2C covers both received and issued invoices. Reporting of billing and payment data will also be supported in 2024.

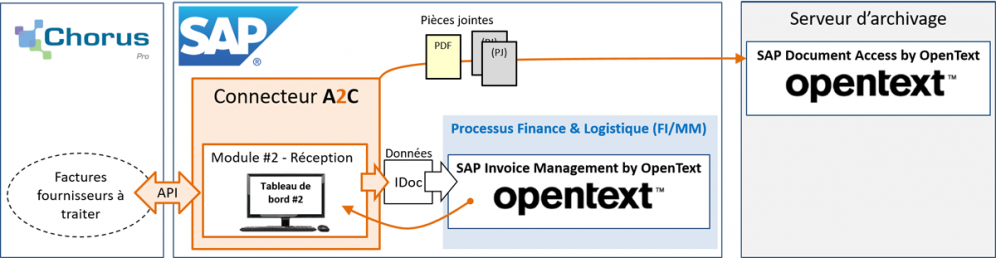

The exchange scheme is as follows:

The main characteristics of the A2C connector are as follows :

Strong connector integrated in SAP :

- Integrated in the SAP backend (ABAP maintenance)

- Secure connections with PISTE APIs

- Quick implementation on an SAP backend.

Customize the connector :

- Configurable IDoc half-interfaces,

- Scalable kinematics,

- Keeping up to date with legal developments

Synchronized data inside Chorus

- Checking the existence of structures in the PPF directory,Suivi

- Monitoring the progress of invoices,

- Manual recovery of incorrect invoices in the states authorized by the PPF..

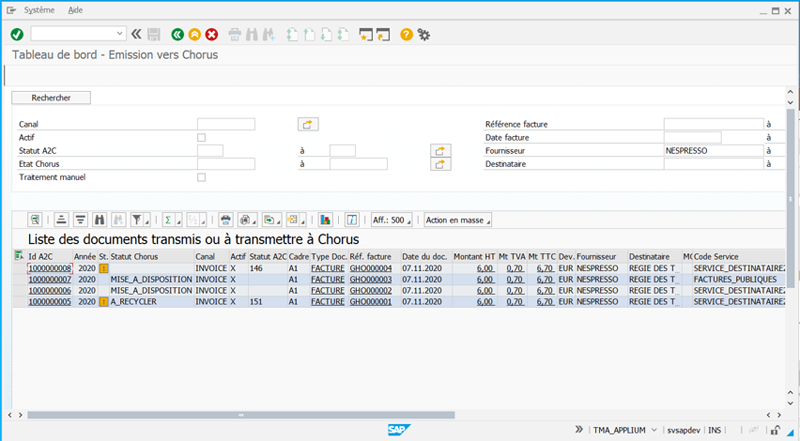

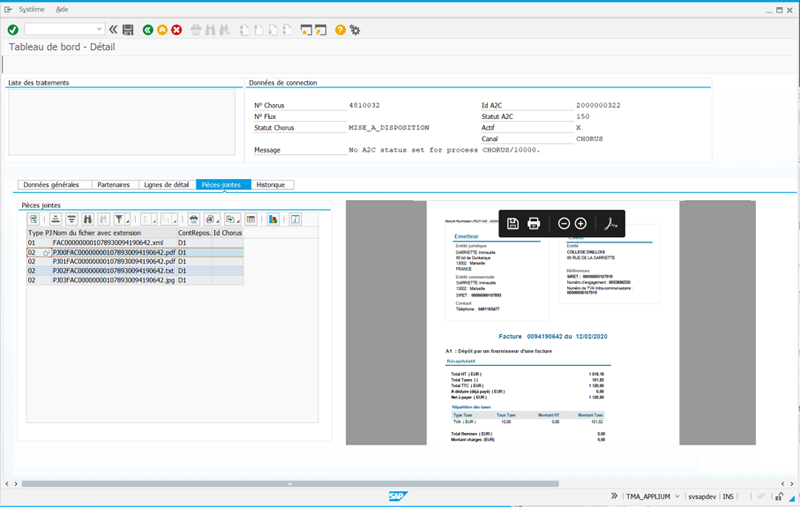

Invoice viewing cockpit:

Dashboards facilitate access to electronic documents.

They display:

- The identifier of each document,

- The main header data,

- Processing status,

- The ‘Lifecycle’ statuses sent by the PPF.

Invoice detail

The advantages of the A2C connector are numerous:

A single connector for issuing and receiving invoices:

- Upload original PDF invoices and attachments to the Chorus Pro portal

- For public structures, loading of invoicing files from Chorus Pro

- Dashboard with invoice status and progress

Intregated in SAP by design :

- Natively integrated with SAP ECC6 (any version of EHP) and SAP S/4HANA

- A direct and secure connection to the Chorus Pro portal in API mode (PISTE)

- Submission by structured invoice flow (E1) or mixed invoice flow (E2) in UBL format (OASIS UBL2.1)

- Loading of invoicing files in AIFE's PIVOT format, returned in IDOC

Low cost solution :

- Based on AIFE's free exchange services

- Without third party remote transmission,

Mise en œuvre rapide :

- Implémentation peu invasive par connexion aux programmes d'édition SAP existants

- Documentation standard livrée (prérequis, spécifications, paramétrage, exploitation)

- Transparent pour les utilisateurs

Integration native avec les solutions de dématérialisation et archivage OpenText

Le connecteur A2C fonctionne nativement avec les solutions OpenText

- If tSAP Invoice Management by OpenText (VIM) solution is installed on SAP:

- VIM can use the IDoc INVOIC02 through the 'EDI' channel, VIM can be configured to send the collected states (Rejection / Suspension / Recycling request) to the A2C connector.

- If the SAP Document Access by OpenText solution is installed:

Images (main PDF and other attachments) can be archived in Document Access in connection with the invoiceVIM peut exploiter l’IDoc INVOIC02 au travers du canal ‘EDI’,

Webinar of September 16th 2021

A presentation and demonstration webinar of the A2C addon took place on September 16, 2021. Below is the link to the recording of this webinar.

replay of the webinaire A2C

Go further

Beyond Chorus, Applium also meets the legal obligations of remote declaration implemented in several European countries and around the world (SII in Spain, FatturaPA in Italy, etc.). Our team has the necessary expertise to advise and produce an estimate within the framework of these regulatory obligations.